HIGHLIGHTS: AUGUST 4, 2023

• Health and wellness seminar in Japan

• USDEC highlights U.S. dairy environmental commitment at APEC meeting

• Supplemental comments on ocean carriers refusal to negotiate

• U.S. dairy ingredient media collaboration in Asia

• APHIS modifies service fee process

• Algeria exempts milk powder from halal requirements

• USDEC updates 70 Export Guide documents in July

• Market Summary: WMP plunges at GDT

• Japan announces new butter tenders through December

• Dairy sales raise anti-trust concerns

• Company news briefs: Nestlé, FrieslandCampina, Leprino, Danone

Featured

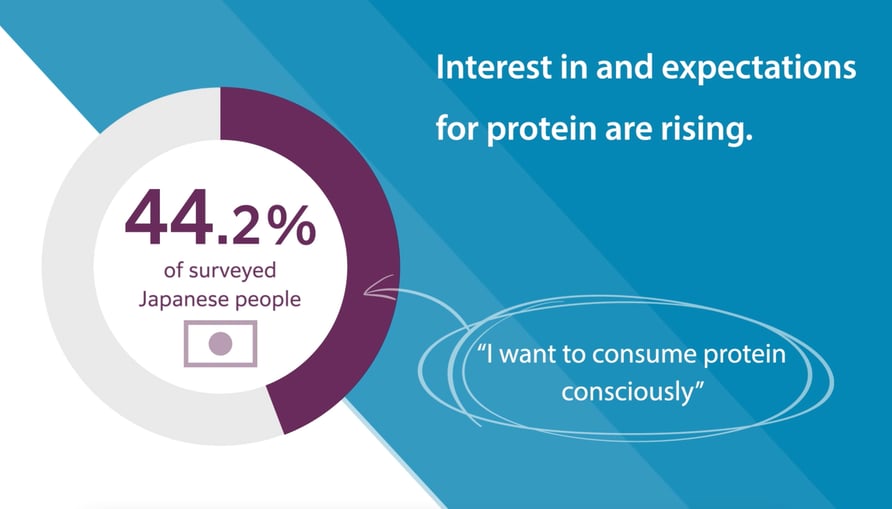

Health and wellness seminar highlights U.S. dairy proteins in everyday Japanese foods

On Aug. 1, more than 150 food and beverage professionals, primarily R&D personnel, attended USDEC’s first in-person, business-to-business seminar in Tokyo since before the pandemic. The health-and-wellness seminar, “More Protein for Everyday Eating: Inspiration for Protein Fortification with U.S. Dairy Proteins,” focused on how dairy proteins—including WPC , WPI, MPC and MPI—fit into products and menus typically consumed in the Japanese daily diet.

The centerpiece of the seminar was an “everyday eating” luncheon featuring a menu of eight prototype products developed in conjunction with USDEC’s partner in the region Kiyota Sangyo. All were commonly consumed Japanese foods made with U.S. dairy proteins: takoyaki octopus balls, Caesar salad dressing with veggies, tuna mayonnaise filling for onigiri rice balls, furikake seasoning rice topper, miso soup, dorayaki red bean pancakes, warabi mochi and hamburger steak.

Seminar attendees engage at this week’s USDEC health-and-wellness seminar in Tokyo, sampling prototypes of common Japanese foods made with U.S. dairy proteins and taking pictures of the presentations during the luncheon.

Tomohiro Murashige and Yusara Ozaki from the Research and Development Division of Kiyota Sangyo guided attendees through the luncheon tasting session, highlighting the innovation possibilities. Their explanations of the prototypes emphasized the nutritional benefits and Japanese consumer need for increased protein intake—and the market opportunity for boosting protein content of everyday Japanese foods. They also provided technical tips gleaned from their own formulation trials to better position the audience for success as they pursue protein-boosted food and beverage products of their own.

While USDEC and Kiyota Sangyo served the prototypes as a prepared meal at the seminar, all are meant for commercial consumer packaged goods.

“The response was overwhelmingly positive. Not only did we attract a large crowd to the seminar, but attendee engagement was very strong,” said Kristi Saitama, USDEC vice president, Global Ingredients Marketing. “For example, there was a huge line waiting to talk to both food scientists after the seminar.”

Tomohiro Murashige, head of Kiyota Sangyo’s Research and Development Division, highlights how U.S. dairy proteins can be used to create innovative new products that fit seamlessly in the Japanese diet.

In addition to the luncheon, a lineup of dairy experts provided information on U.S. dairy protein opportunities and background on USDEC and the U.S. dairy industry.

- Chanda Berk, director of USDA’s Agricultural Trade Office in Tokyo, set the stage, outlining the bright prospects for protein-boosted foods for health and wellness in Japan regardless of age or gender.

- Hisao Fukuda, business development director at USDEC’s Japan office, highlighted how USDEC works with and supports Japan's food industry on innovation opportunities and highlightedS. dairy's environmental sustainability legacy and commitment to carbon neutrality, further reinforcing U.S. dairy's role as an environmental solution.

- Donna Berry, food scientist and owner of Dairy & Foods Communications, reiterated “there’s lots of room to grow” protein-boosted product innovations in Japan. Berry provided real commercial examples of dairy-protein-fortified foods across multiple mainstream product categories beyond sports nutrition and smoothies, like cookies and baked goods, snacks, beverages and “permissible indulgence” desserts. One newer area of focus is on relaxation products that claim to support mental and emotional well-being to help people cope with stress and hectic lifestyles. Product examples included Premier Protein's ready to drink “Good Night” Dreamy Vanilla beverage (made with MPC) and Cozy Cocoa Mix (made with MPI) that “support a healthy sleep routine,” and Nightfood's sleep-friendly cookies (made with micellar casein protein).

- Berry and USDEC Consumer Insights Analyst Scott Lantz sat down for a Q&A panel discussion moderated by USDEC Japan's Hiroshi Furuyama, senior marketing manager, about opportunities for further growth and innovation with dairy proteins. While recognizing strong and positive inroads in Japan, they both emphasized significant untapped potential, particularly in categories such as snacks and better-for-you indulgence foods.

At this week’s health-and-wellness seminar in Japan, USDEC shared the Japanese version of a three-minute video—“Protein Consumption Status and Consumer Perspectives in Japan”—developed by the Global Ingredients Marketing team.

USDEC highlights U.S. leadership on climate-smart ag at APEC ministerial meeting

USDEC continued its ongoing engagement with the Asia-Pacific Economic Cooperation (APEC) this week at a ministerial meeting in Seattle. The purpose of APEC, a group of 21 Asia-Pacific economies, is for government officials to find ways to facilitate trade and share information on a number of different economic sectors.

The United States is the host for APEC meetings in 2023, and USDEC has been very active in the organization this year as in past years. In May, USDEC's Shawna Morris, senior vice president for Trade Policy, participated in an APEC meeting in Detroit to highlight the importance of preserving smooth dairy trade flows with our FTA partners and of increasing trade relations further with the Philippines (see Global Dairy eBrief, 5/26/23).

On Thursday, USDEC and NMPF hosted a luncheon for the APEC countries at the Seattle ministerial. More than 100 government officials from most of the economies attended the luncheon, including ministers, vice ministers and senior officials. Climate-smart ag issues as well as broad policy topics were discussed.

USDEC and NMPF staff and members presented on the U.S. dairy sector’s important role in USDA’s Partnerships for Climate-Smart Commodities program. USDA’s Partnerships for Climate-Smart Commodities Program supports voluntary, producer-led initiatives to increase on-farm adoption of climate-smart agricultural technologies and practices.

Comments to FMC seek further revisions on ocean carriers’ unreasonable refusal to deal of negotiate on vessel space

On July 28, USDEC and NMPF submitted comments to the Federal Maritime Commission (FMC), providing additional feedback on how the FMC can best hold ocean carriers responsible for unreasonably refusing to deal or negotiate with respect to vessel space accommodations—an unfair practice that is especially harmful to dairy exporters.

This is the second set of comments related to carriers’ unreasonable refusal to negotiate that USDEC and NMPF filed as part of the Ocean Shipping Reform Act (OSRA) implementation process and comes in response to FMC’s supplemental notice of proposed rulemaking (SNRPM). As part of FMC’s implementation of the OSRA, USDEC and NMPF have consistently engaged with the agency, providing industry perspectives and suggestions on specific rulemaking.

FMC was very responsive to the first set of comments on the issue from USDEC and NMPF (see Global Dairy eBrief 10/21/22), citing them over 20 times in revisions to its revised rules in the SNRPM.

The supplemental comments offer further suggestions on the scope and implementation of the FMC’s proposed rules related to refusal to negotiate, vessel service execution, publication of ocean carriers’ export policies and certification rules related to carriers’ justifying their actions.

While the comments suggest additional changes, USDEC and NMPF applauded the revisions in the SNRPM and commended the FMC for taking its rulemaking responsibilities, for its responsiveness to comments and feedback, and for its efforts to expedite the new prohibitions expeditiously.

Media collaborations raise profile for U.S. dairy ingredients in Southeast Asia

USDEC continues to elevate the U.S. dairy profile with Asian food and beverage makers through collaboration with regional media, both paid and earned. Most recently, USDEC took out a full-page ad on the inside cover of the July/August issue of Asia Pacific Food Industry Magazine (APFI).

The ad reinforces how U.S. dairy ingredients help nourish people while protecting the planet. It links to the U.S. Center for Dairy Excellence (U.S. CDE) in Singapore, where readers can find more information on how USDEC works to accelerate customer success.

In addition to the ad, APFI sent out an eBlast to its subscriber base highlighting the innovation potential of U.S. dairy ingredients and how they can be used to create Asia-friendly products that deliver on flavor and nutrition. Meant to inspire creativity, the message includes links to a USDEC new-product page with formulations for more than 70 foods and beverages tailored to Southeast Asian tastes and showcasing U.S. dairy ingredients.

A video link in the eblast shines a spotlight on the U.S. dairy farming sector and how continual innovation has made U.S. milk producers some of the most efficient in the world. In an interview recorded during the June farmer mission to Southeast Asia, USDEC Marketing Manager, Global Ingredients Marketing Keith Meyer talks with Corey Geiger, former managing editor of Hoard’s Dairyman, about U.S. milk production, U.S. dairy productivity and other factors that distinguish the United States from other global suppliers.

Still to come, a cover story in the September issue of APFI will feature an interview with USDEC Southeast Asia’s Technical Director, Food Applications Martin Teo and many of USDEC’s new prototypes. Another eBlast set for Sept. 14 is strategically timed to precede USDEC’s participation in the Fi Asia Thailand show in Bangkok, Sept. 20-22, and spur traffic to the USDEC booth. (For questions on Fi Asia Thailand, please contact Keith Meyer at kmeyer@usdec.org.)

Month-long Food Navigator Asia billboard

In addition to the APFI outreach, USDEC is running a banner ad for the entire month of August on FoodNavigator-Asia.com. The ad spotlights beverage uses for U.S. dairy ingredients and is timed to spur interest in upcoming USDEC beverage-focused workshops scheduled for Sept. 7 and 8 at the U.S. CDE. (For more information on the workshops, please contact Kristi Saitama at (ksaitama@usdec.org.)

Market Access and Regulatory Affairs

APHIS modifies service fee process

In the Aug. 1 Federal Register, USDA’s Animal and Plant Health Inspection Service (APHIS) issued a final rule revising the regulations related to user fees charged for several services, including export health certificates. The final rule indicates that APHIS will remove the tables providing individual fees from the regulations and post them on an APHIS website. APHIS will also modify the frequency with which fees are determined, moving from an assessment once every five years to an annual review of fee rates. The FR notice indicates that this change to annual fee reviews using formula-based calculations will enable APHIS to avert potential funding shortfalls and benefit financial planning.

Although the notice itself does not establish new fees, the new rule may result in more frequent fee increases for export certificates, which have remained constant for the past 12 years. Before changing any fees, APHIS will propose changes to the rates through a notice in the Federal Register and accept public comments. Following the comment period, APHIS will issue a notice in the Federal Register providing the final rates. USDEC will continue to reflect current fees in Volume 2 of the Export Guide.

Algeria exempts milk powder from halal certification requirements

Algeria has modified its new halal requirements (see USDEC’s June 29 Member Alert) to exempt milk powder, meaning milk powder shipped to Algeria does not have a regulatory requirement to be certified as halal. However, please note that the exemption applies only to milk powder; all other U.S. dairy products shipped to Algeria still require halal certification from a U.S. halal certifier.

USDEC updates 70 Export Guide documents in July

USDEC’s Market Access and Regulatory Affairs (MARA) team updated or revised 70 documents in the USDEC Export Guide last month. Changes include:

Volume 1: Tariffs and Classification

- Argentina: Tariffs on infant formula of 1901.10.10 and 2106.90.90 and calcium caseinate powder of 3501.90.19 are reduced by 2% for one year.

- Brazil: Information for temporary 0% most-favored-nation tariff rate quotas added for infant formula of 2106.90.90, sodium caseinate of 3501.90.11, and calcium caseinate of 3501.90.19.

- Israel: Tariffs on fluid milk of HS 0401.10 and 0401.20 are eliminated through Oct. 9, 2023.

Volume 2: Import Requirements

- Australia: APHIS has updated the Veterinary Certificates for both “Dairy Products (other than cheese and butter)” and “Cheese and Butter.”

- Chile: Updated links from Chile’s Agriculture and Livestock Service (SAG) website related to registered plants and approved monographs.

- Colombia: Included information regarding the current certifying bodies for the certificate of conformity. Additionally, updated the extension of the deadline for Plant Registration with the Agriculture and Livestock Institute of Colombia (ICA) until Dec. 31, 2023.

- Qatar: Updated transportation requirements to indicate the new palletization requirement and penalties for non-compliance.

Volume 3: Compositional Standards and Labeling Requirements

- China: Added two regulations to the “Other Regulations” section: 1) Allowed Nutritional Fortification Substances in Foods; and 2) Maximum Residue Limits for Pesticides and Veterinary Drugs in Food.

- Indonesia: Noted revisions to all compositional standards in line with Indonesia’s revised regulation on Food Categories.

- Peru: Labeling document now notes the allowances for the use of stickers or direct printing on the front side of the label in the case of imported food and beverages (for front of pack warnings). If stickers are used, they must be permanent, hard to remove, and resistant to low and high temperatures, and they must have good adhesion to the type of surface being used.

Every month, USDEC’s Market Access team emails a list of guide updates to interested members. If there is anyone at your company who should be included on the distribution list for that email in the future, please contact Jessica Smith at jsmith@usdec.org.

Market Summary

GDT drops on WMP plunge

The Global Dairy Trade (GDT) Price Index fell 4.3% at the Aug. 1 auction as the bottom fell out of WMP and nearly every other product failed to generate any pricing traction. It was the fifth GDT Price Index decline in the past six auctions (and the only non-decline in that span was a flat result on June 20).

Prices can’t seem to find a bottom despite modest (and falling) gains in milk production from the world’s major suppliers and tentative (but unsteady) signs of improvement in demand from China. North Asia (China), in fact, recaptured the top buying slot at the Aug. 1 auction, after ceding that position to Southeast Asia for four straight auctions. China increased WMP, SMP and cheese volume compared to both the previous auction and the same auction in 2022.

But supply is still outrunning demand overall and no region is inclined to bid up prices.

The average winning WMP price plunged 8.0% to US$2,864/MT, the lowest price since June 2020. It was the fifth auction decline in a row.

SMP fell 1.4% to US$2,454/MT, the lowest since May 2020 and the sixth decline in a row.

Butter dropped 0.7% to US$4,680/MT; butterfat slipped 0.5% to US$4,750/MT and cheddar declined 1.4% to US$3,910/MT.

ALIC schedules butter tenders through year-end

Japan’s Agriculture and Livestock Industries Corp. (ALIC) announced butter tender plans for the remainder of the calendar year. All tenders are SBS. Dates and volumes are as follows:

- Aug. 10: 2,000 MT butter.

- Sept. 14: 700 MT butter.

- Oct. 12: 800 MT butter (volume is subject to change depending on supply and demand conditions).<

- Nov. 16: 800 MT butter (volume is subject to change depending on supply and demand conditions).

- Dec. 14: 800 MT butter (volume is subject to change depending on supply and demand conditions).

Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) will announce further tender plans for fiscal 2023 (which runs through March 31, 2024) after it reviews the supply situation moving forward. For more information, contact USDEC’s Japan office at usdecjapan@marketmakers.co.jp or (011) 81-3-3221-6410.

Company News

Potential dairy asset sales raise antitrust concerns

Competition concerns have been raised in three pending dairy asset deals, causing anti-trust regulators to call for further investigation before allowing the deals to close. In Brazil, antitrust regulators are challenging Nestlé and Fonterra Co-operative Group’s planned sale of Dairy Partners Americas Brazil to Lactalis. Technical staff at the Council for Economic Defense (CADE) recommended that the regulator block the US$147-million deal because it would likely cause horizontal competition in the Brazilian dairy products market, particularly among the dairy desserts, fermented milk and petit-suisse categories. CADE’s court will conduct a broader review of the deal before voting on its approval.

In Ireland, regulatory authorities announced they will conduct a full Phase 2 investigation of the proposed acquisition by Aurivo Consumer Foods of certain assets of Arrabawn Co-Operative Society. The Competition and Consumer Protection Commission (CCPC), said a full investigation is needed to ensure the proposed deal, in which Aurivo would acquire parts of Arrabawn’s business for the supply of branded and unbranded liquid milk, cream and butter products, does not lead to “a substantial lessening of competition in the State."

Australia’s Competition and Consumer Commission (ACCC) also identified competition concerns about a proposed deal for Coles Group Limited to acquire two fresh milk processing facilities from Saputo Dairy Australia. The ACCC cited concerns that the acquisition would give Coles, one of Australia’s largest grocery retailers, too much influence in the dairy supply chain. The watchdog is also considering whether the deal would limit competition, which could cause farmers to receive lower prices for their raw milk. (Reuters, 7/25/23; CCPC, 7/14/23; DairyReporter.com, 7/24/23)

Corporate report recap

USDEC brings you results highlights from recent half-year reports from major global dairy suppliers.

Nestlé

Nestlé reported broad-based growth across most categories and regions. Dairy group sales rose at high-single-digit pace, with strong demand for coffee creamers and affordable fortified milks. Middle East and Africa saw double-digit growth, with infant nutrition as the largest contributor, led by Lactogen, NAN and Cerelac. In Brazil, dairy posted double-digit growth, supported by fortified milks and dairy culinary solutions, while infant nutrition increased by double-digits as well, based on solid momentum for NAN and Nido growing-up milks. And in China, infant nutrition saw mid-single-digit growth, led by NAN specialty offerings and illuma.

FrieslandCampina

FrieslandCampina reported a “challenging” first half, citing “sharply declined commodity dairy prices and lower volumes.” One bright spot was the performance of specialized nutrition, which reported strong revenue and operating profit figures, partially driven by growth in infant nutrition sales under the Friso Prestige brand in the ultra-premium segment in China. (Company reports)

Company news briefs

Leprino Foods expanded its relationship agreement with Illinois-based ingredients distributor Univar Solutions. Univar’s Mexican and Brazilian units will distribute Leprino’s nutritional ingredients and dairy products in their respective markets. Leprino said the deal “reinforces our commitments to the food ingredients and nutrition market.” Earlier this year, Leprino selected Univar as an authorized distributor for Canada and the United States. … Japanese probiotic beverage maker Yakult is building a $305-million production facility in Bartow County, Georgia. The company expects to commence manufacturing at the beverage plant in 2026. … Danone claims it remains the legal owner of its operations in Russia despite a Russian decree in July putting the business under “temporary management” of the government (see Global Dairy eBrief, 7/21/23). The government justified that move with recently passed rules aimed at companies from “unfriendly” countries. Just prior to the takeover, Danone said it was localizing its Activia brand in Russia, renaming it AktiBio. A company spokesperson said, “What’s going to happen in the future? We don’t know.” (Company report; Al Bawaba, 7/29/23; FoodBev.com, 7/28/23; Bloomberg, 7/26/23)

In Case You Missed It...

U.S. Dairy Exporter Blog

Market analysis, research and news subscribe hereUSDEC Twitter feed

Follow us here.