HIGHLIGHTS: March 3, 2023

• Lawmakers urge action on common name threat

• Court upholds generic status of 'gruyere'

• Schwager named new CCFN chair

• Indonesia meeting yields additional U.S. plant listings

• Harden talks supply chain at TPM23

• India delays health certificate implementation

• LOL’s Ford named to President’s Export Council

• Membership renewal reminder

• Membership Meeting: a congressional perspective on ag, trade and supply chain

• Market Summary: NZ exports start strong in 2023

• December International Demand Analysis

• Feedback on EU packaging proposal due March 13

• February updates to the USDEC Export Guide

• ILWU, PMA issue statement on labor negotiations

• Leprino to buy Glanbia Cheese

• Company news: Baladna, Bel Group, Bega

Featured

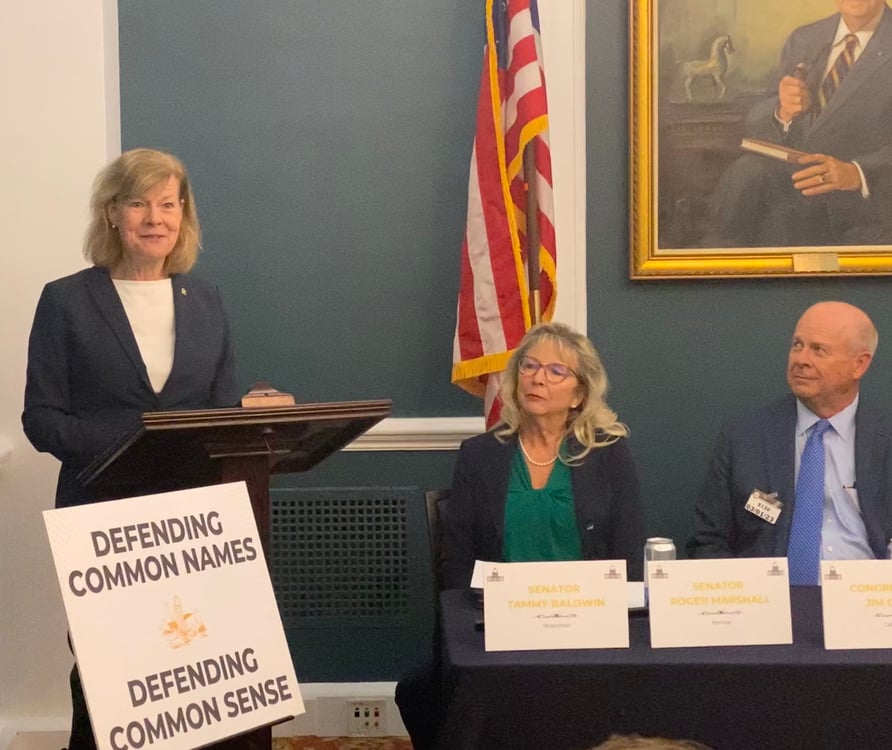

Lawmakers urge action on common names at Hill event

On Wednesday on Capitol Hill, lawmakers and U.S. industry representatives called for more focused and assertive U.S. government actions to counter aggressive efforts by certain trading partners—the EU in particular—to monopolize common names under the guise of geographical indications. The Consortium for Common Food Names (CCFN, founded by USDEC), and Agri-Pulse organized the event.

Sens. Tammy Baldwin (D-WI) and Roger Marshall (R-KS) and Reps. Adrian Smith (R-NE) and Jim Costa (D-CA) spoke at the meeting along with Jeff Schwager, CCFN chairman, Chad Vincent, CEO of Dairy Farmers of Wisconsin, Shawna Morris, USDEC senior vice president, Trade Policy, and representatives from the U.S. wine, meat and rice sectors.

“The EU is focused on limiting where we can go—whether it’s cheese, wine or meats,” warned Schwager. “Our future is at stake and we really need help to combat what the European Union is trying to do.”

What the EU is trying to do is lock out competition around the world, multiple speakers said.

“Let’s call it what it is,” said Rep. Costa. “This is a non-tariff barrier.”

Rep. Jim Costa (D-CA) was one of four U.S. lawmakers to speak at this week’s Capitol Hill event to urge stronger U.S. government leadership on efforts of U.S. trading partners to monopolize the use of common food and beverage names.

The speakers underscored the need for the USTR and the USDA to proactively establish with U.S. trading partners strong protections for common names, using whatever tools are necessary to preserve access for U.S. exports to those markets. Congressional participants also cited the farm bill as a possible means of spurring action on a proactive common names agenda.

The U.S. needs to prioritize common names in current and future trade negotiations, said Sen. Baldwin. “As the European Union is negotiating agreements with many of our trading partners and undermining export opportunities, we cannot wait on the sidelines as these deals get made.”

The ability to export cheese and other products using common names “is absolutely critical for sustaining the good-paying jobs this industry supports and maintaining our robust farming and processing industry,” stressed Sen. Tammy Baldwin (D-WI).

In a CCFN press release on the event, Jaime Castaneda, CCFN executive director, stated: “The bipartisan message today rang loud and clear: The U.S. will not tolerate the EU’s efforts to bar U.S. companies from global customers by misappropriating widely used common names, and immediate actions are needed by the U.S. government to effectively tackle the EU’s harmful tactics.”

Court upholds ‘gruyere’ as generic in major victory for U.S. dairy

The U.S. Court of Appeals for the Fourth Circuit upheld the prior decisions of the U.S. District Court for the Eastern District of Virginia and of the U.S. Patent and Trademark Office’s Trademark Trial and Appeal Board in finding “gruyere” to be a generic term for a variety of cheese. The Fourth Circuit found that the evidence “is ‘so one-sided’ that there is no genuine issue as to any material fact and Opposers must prevail as a matter of law.”

The court’s clear decision should put an end to the attempt by Swiss and French consortiums to expropriate a common food name through a U.S. certification mark registration.

CCFN, USDEC and NMPF hailed the ruling today in a joint press release. CCFN, backed by its member companies and both dairy organizations, committed significant resources to building the case for gruyere as a generic term and crafting a successful argument that non-European companies should retain their rights to make and sell the cheese in the U.S. The precedent-setting case was an important one for CCFN’s broader global efforts to preserve the use of a wide variety of generic names.

CCFN Executive Director Jaime Castaneda called the ruling a “momentous victory for American consumers, farmers and food manufacturers.”

USDEC President and CEO Krysta Harden added: “This sets a terrific precedent for the right to use common food names in the United States. Now we need other countries to likewise stand up for what’s right and defend that use just as strongly.”

CCFN video explains common name threat

CCFN created a 2.5-minute informational video to explain the issue of common food names, the threat from the EU’s aggressive program to monopolize them and CCFN’s extensive efforts to preserve the rights of U.S. companies to continue using them. The video features a number of USDEC members outlining their common name concerns. USDEC encourages members to promote and share the video to build further support for common name defense.

Schwager named new CCFN chair

Earlier in the week, CCFN appointed Jeff Schwager as its new chairman. The former CEO of Sartori takes over from Errico Auricchio, president of BelGioioso Cheese, who has led CCFN since its founding in 2012. “While we face many challenges around the world, I’m optimistic because of the foundation that Errico has laid, and because of the commitment that our members have for this issue,” said Schwager. “The EU isn’t going to stop fighting, but neither are we.”

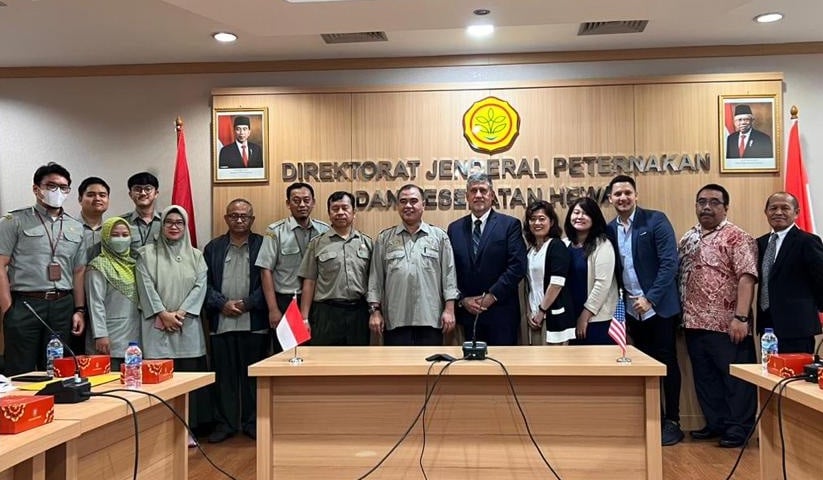

Indonesia announces three more U.S. plant listings at high-level meeting with USDEC

It is rare that the head of Indonesia’s Livestock and Animal Health Services in the Ministry of Agriculture meets with a foreign export group. But that is exactly what happened this week when Director-General Nasrullah met with USDEC Senior Vice President, Market Access and Regulatory Affairs (MARA) Jonathan Gardner and the USDEC Southeast Asia team. The group gathered to discuss technical matters of concern in the U.S. dairy plant registration process and to affirm U.S. dairy’s continued commitment as a partner for the country’s food and beverage industry.

As a result of the meeting and USDEC's ongoing MARA global engagement efforts, Indonesia listed three approved USDEC-member plants that had been waiting to be posted in their online system.

Gardner is in Thailand and Indonesia this week to establish and strengthen relationships with key regulatory stakeholders in both countries. Working with the Southeast team, he is reviewing market access concerns and discussing the latest regulatory issues affecting U.S. dairy exports.

Jonathan Gardner and the USDEC Southeast Asia team met this week with Dr. Ir. Nasrullah, Director-General of Indonesia’s Livestock and Animal Health Services, Ministry of Agriculture, to discuss dairy plant registration and the U.S. commitment to the Indonesian dairy sector.

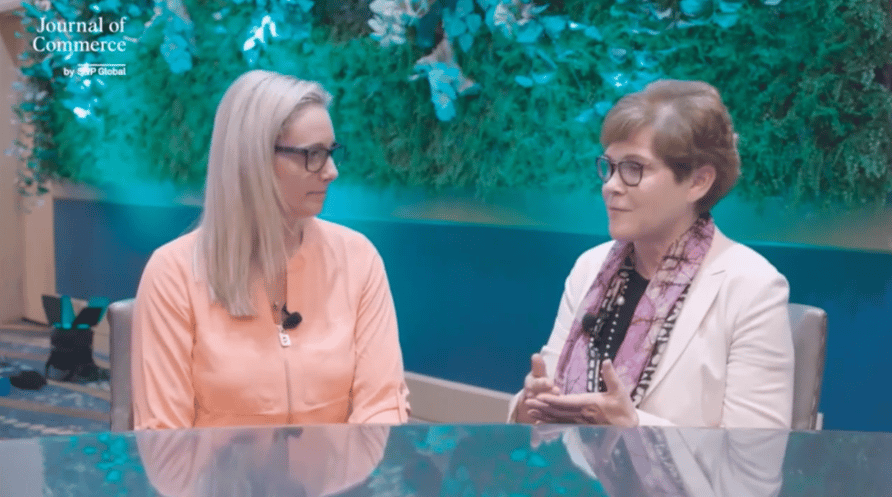

USDEC at TPM23: ‘battle-tested’ and focused on future growth

On Monday, USDEC CEO Krysta Harden shared how dairy exporters are adapting to the “new normal” of pandemic-era global supply chains. “One silver lining of the shipping crisis has been that no one is taking our supply chain for granted,” Harden said. “Dairy exporters are battle-tested and now have a better understanding of how to navigate supply chain uncertainty.”

Harden spoke during a session at TPM23, held Feb. 26-March 1 in Long Beach, California. The annual event hosted by the Journal of Commerce was attended by more than 3,600 trans-pacific and global container shipping and logistics leaders. The conference marks the unofficial start of the shipping contract negotiations season.

During a “fireside chat” with S&P Global Senior Editor Janet Nodar, Harden highlighted how the dairy industry is looking ahead to expand access to international markets. “American agricultural exports aren’t just important for the millions of jobs they support here at home—they also provide food and nutritional security to billions around the globe,” she said.

USDEC President and CEO Krysta Harden addressed an audience of over 3,600 shipping executives and port officials at TPM23, the world’s largest supply chain conference.

While U.S. dairy exports reached a new record in both value and volume in 2022, Harden noted that addressing ongoing supply chain challenges will be critical to growing that number in the future. Dairy exporters continue to grapple with seaport congestion and shipping delays, facing costly challenges such as rolled bookings, broken contracts, and low shipping container availability.

USDEC played an instrumental leadership role in the development and passage of the Ocean Shipping Reform Act (OSRA), a critical step in the right direction to ensure ocean carriers do not show an unfair preference for imports over exports. As the implementation process moves forward, USDEC supports putting new guardrails in place that clarify what constitutes an “unreasonable” refusal to carry U.S. exports by carriers while increasing exporters’ access to accurate information from carriers on shipping schedules, container and chassis availability and fees.

“OSRA puts us in a much stronger position should a supply chain crisis occur again,” Harden said, noting USDEC’s engagement during the Federal Maritime Commission’s ongoing rule-making process. “Carriers calling on U.S. ports have an obligation to service both import and export needs—a message made loud and clear by Congress with an overwhelming bipartisan vote on OSRA last June.”

TPM23 was an important opportunity for USDEC to show thought leadership and strengthen relationships with global shippers as dairy exporters face a wide range of potential new disruptions in 2023, from ongoing labor challenges to shifting geopolitics and cybersecurity threats. Amid these constantly shifting trade dynamics, USDEC will keep an eye to the future to ensure the industry is well-positioned for what comes next.

Harden also recapped some of the main messages of her presentation in an interview with Sarah Barnes Humphrey, host of the Journal of Commerce’s TPM TV. You can view that full five-minute talk here or by clicking on the image below.

India delays implementation of new health certificate

The Food Safety and Standards Authority of India (FSSAI) issued an order on Feb. 24 delaying the implementation of its model health certificate until further notice. This delay means that the FSSAI certificate will not be implemented on March 1 as previously scheduled.

With this information, the import requirements into India remain status quo. See Volume 2 of the USDEC Export Guide for more information on India’s health certificate requirements.

Please note that these requirements may change at any time, and all shipments to India are at the exporter's own risk.

USDEC continues to work with the USG on a possible resolution to the market access challenges in India. Contact Sandra Benson at sbenson@usdec.org with any questions on the current requirements.

LOL’s Ford to serve on President’s Export Council

President Biden named Beth Ford, president and CEO of Land O’Lakes (LOL), to serve on the President’s Export Council. The 25-member Council serves as the president’s principal national advisory committee on international trade. It advises the president of government policies and programs that affect U.S. trade performance, promotes export expansion, and provides a forum for discussing and resolving trade-related problems among the business, industrial, agricultural, labor and government sectors.

Membership renewal due March 15

All USDEC members should have received membership renewal notices in January. If you have not received the invoice or have any questions, please contact Weston Abels at wabels@usdec.org. Membership renewal fees are due by March 15. Thank you, and we appreciate your support!

Events

Membership Meeting: Rep. Dusty Johnson to give congressional perspective on ag trade and supply chain

Congressman Dusty Johnson of South Dakota has been a champion for U.S. dairy exporters with his leadership on the Ocean Shipping Reform Act of 2022 and tenure on the Committee on Agriculture in the House of Representatives. Rep. Johnson will join USDEC President and CEO Krysta Harden on March 28 at the USDEC Spring Membership Meeting for a talk on agricultural trade, the farm bill and supply chain policy in the 118th Congress.

The meeting runs March 27-29 at the Willard Intercontinental Hotel in Washington, D.C. Download the preliminary agenda to see the full slate of invited and confirmed speakers. Register to attend the meeting by clicking here.

(The deadline for hotel reservations at the Willard has passed. If you have any issues with reservations, please contact Louise Kamali at lkamali@usdec.org.)

Invite a colleague!

Not everyone at our member companies receives USDEC communications. If you know a colleague you feel would be interested in attending the meeting, USDEC encourages you to reach out and extend an invitation. Click here to generate an email with a link to USDEC’s information page for the meeting, which includes registration and agenda information. (Please note that some browsers may block the automatic composition of emails.)

Market Summary

New Zealand exports start strong in January

New Zealand kicked off 2023 on a positive note. Dairy export volume (major products, not including fluid) increased 19% to nearly 275,000 MT, marking the country’s best January since 2020. WMP, SMP, cheese, butterfat, whey and lactose all posted gains—nearly all double-digit.

Notably, New Zealand recorded the gains despite a continued decline in WMP exports to China—its largest-volume export to its biggest customer. As noted in the just-released December edition of USDEC’s International Demand Analysis (see below), China’s lagging WMP demand has been shifting dairy export calculus, pushing New Zealand to focus on alternative markets and products. That can be seen continuing in the country’s January export numbers.

New Zealand WMP exports recorded the lowest growth rate of any major product category in January: +7% (+8,325 MT). But WMP shipments to China fell 2% (-2,012 MT), as Kiwi suppliers redirected their focus to Southeast Asia (+30%, +8,344 MT) and the Middle East/North Africa (+25%, +5,592 MT).

At the same time, year-over-year New Zealand SMP exports in January jumped 70% (+21,107 MT), butterfat grew 16% (+6,084 MT) and cheese rose 14% (+4,601 MT).

The situation translates into increased competition for U.S. dairy suppliers, at least until China regains its WMP appetite. On the plus side, the Chinese economy began to show some green shoots in January and February. On the minus side, as noted in the International Demand Analysis, heavy domestic Chinese WMP production and uncertainty surrounding the country’s WMP inventories leave plenty of questions about when China will return in force to the WMP market.

December International Demand Analysis ready for download

Year-over-year global dairy trade fell 1% in December 2022, the second monthly decline in a row. Solid gains in volume to the Middle East/North Africa (+10%), Mexico (+30%) and South America (+27%) failed to offset weakness in Southeast Asia (-15%) and China (-8%).

Despite the decline, December data contained some positive developments. NFDM/SMP trade jumped 16%, largely due to a banner month from the EU27+UK, which cleared out inventory built up over the summer. And cheese trade returned to growth (+3%) led by a strong month from U.S. suppliers.

For details on December performance, download USDEC’s latest International Demand Analysis. The 70-page document is packed with charts, graphs and commentary, providing a forward-looking glimpse at global markets from a U.S. exporter’s point of view. It analyzes demand in key markets for cheese, NFDM/SMP, whey (HS Code 0404.10) and WPC80+, and also includes shorter summaries for lactose, butterfat and WMP. For questions, please contact William Loux at wloux@usdec.org or Stephen Cain at scain@nmpf.org.

Market Access & Regulatory Affairs

MARA requests member feedback on EU packaging proposal by March 13

In follow up to a piece in the Feb. 10 Global Dairy eBrief, the MARA team has set March 13 as the deadline for members to submit feedback on the EU’s packaging sustainability proposal, “Reducing packaging waste – review of rules (PPWR).” With this proposal, the European Commission (EC) has put forward new rules on recycling, reusable packaging, transport packaging, labeling and packaging conformity assessment.

A link to USDEC’s overview document on this proposal can be found on the EU Country Dashboard page in the USDEC Export Guide. Contact Sandra Benson at sbenson@usdec.org with questions or comments.

USDEC updates more than 100 Export Guide documents in February

USDEC’s Market Access and Regulatory Affairs (MARA) team updated or revised 102 documents in the USDEC Export Guide last month. Changes include:

Volume 1: Tariffs and Classification

- Korea: Updated MFN quota volumes and allocation for the milk powder and whey quotas.

- Nicaragua: Noted value-added tax (VAT) exemption for eligible products of HS 0401 (fluid milk) and 0402 (milk powder, evaporated, condensed milk, etc.); added selective consumption tax information for proteins of HS 3504.

Volume 2: Import Requirements

- European Union: Updated bill of lading to indicate new requirements under the EU’s Import Control System 2.

- Malaysia: Revised U.S. Dairy Plant Registration or Approval section to include an updated DVS application form for dairy products and feed; updated list of approved facilities; updated details on cheese manufactured with plant-based rennet.

- Sri Lanka: Added information on the temporary import suspension of certain dairy products, including condensed milk, yoghurt, chocolate, other food preparations containing cocoa, and beverages based on milk.

Volume 3: Compositional Standards and Labeling Requirements

- Brazil: Updated most compositional standards, including butter, cheese, infant formula and labeling; added new food fortification requirements; removed repealed legislation.

- Chile: Updated milk powder standard, including moisture and fat levels.

- GCC: Added packaging requirements and information on the addition of essential nutrients to foods.

Every month, USDEC’s Market Access team emails a list of guide updates to interested members. If there is anyone at your company who should be included on the distribution list for that email in the future, please contact Jessica Smith at jsmith@usdec.org.

Supply Chain

West Coast contract talks: parties ‘hopeful’

The Pacific Maritime Association and the International Longshore and Warehouse Union issued their first official joint statement since September regarding ongoing contract negotiations. The statement was short on detail but said the two sides “remain hopeful of reaching a deal soon.” The assessment comes on the heels of Port of Los Angeles Executive Director Gene Seroka saying he was “pretty confident” that there finally would be progress in the spring. (Supply Chain Dive, 2/23/23, 2/21/23)

Company News

Leprino to buy Glanbia share of mozzarella joint venture

Leprino Foods signed a non-binding agreement to take full ownership of Glanbia Cheese, the European joint venture it operates with Ireland’s Glanbia plc. Leprino will initially pay €160 million (about US$170 million) for Glanbia plc’s stake, with an additional contingent consideration of €25 million (about US$26 million) over the next three years, depending on business performance.

The deal includes manufacturing plants in Llangefni, Wales; Magheralin, Northern Ireland; and Portlaoise, Ireland. Current Glanbia Cheese CEO Paul Vernon will continue to head the business.

“Having successfully partnered with Glanbia since 2000, we are proud of the high-quality business that we have helped build,” Leprino President and CEO Mike Durkin said. “We look forward to working with Paul Vernon and the local team to ensure a seamless transition for our employees, customers and suppliers. We intend to take advantage of our combined expertise, knowledge and strengths to further enhance the business and are committed to ongoing investments in the core capabilities and the talented people that set us apart from our competition.”

Baladna forms strategic partnership with Bel

Vertically integrated Qatari dairy manufacturer Baladna formed a strategic partnership with French cheesemaker Bel Group. Baladna will begin producing Laughing Cow jarred cheeses this year under the terms of the agreement, but more Bel products are reportedly slated for production “in the near future.” Baladna said the deal will help reduce imports and the potential supply chain disruptions and eventually increase product options for regional consumers. (USDEC Middle East/North Africa office; Company reports)

Bega to close milk plant

Australia’s Bega Cheese is closing its Griffith, Canberra, manufacturing plant following a review of its fresh dairy operations in the Australian Capital Territory and New South Wales. Declining farm numbers and milk production made supplying the facility inefficient and unsustainable. The closure follows the recent shuttering of Saputo’s Maffra, Victoria, plant and Saputo CEO Lino Saputo Jr.’s prediction that he expected more plant closures in Australia due to the country’s shrinking milk supply (see Global Dairy eBrief, 2/24/23). (FoodBev.com, 2/27/23)

Company news briefs

Fast-food player Wendy’s signed a deal with India’s Rebel Foods to scale up the restaurant’s presence in India. Rebel will become the master franchisee, with plans to develop about 150 units over the next decade. Wendy’s originally partnered with Rebel in 2020 to build and operate 250 cloud kitchens across India to grow a home-delivery business in the country. (Bloomberg, 2/27/23)

In Case You Missed It...

U.S. Dairy Exporter Blog

Market analysis, research and news subscribe hereUSDEC Twitter feed

Follow us here.