HIGHLIGHTS: MAY 26, 2023

• USDEC signs MOU with Eucolait

• USDA modifies dairy certificate fees

• Reminder: New APHIS certificate template

• Download: Market Snapshot on Southeast Asia

• First Whey Protein Forum of 2023 in South Korea

• Brazilian workshop highlights U.S. dairy protein use in yogurt, cheese

• Market Summary: Chinese imports steady in April

• Download: USDEC’s latest International Demand Analysis

• Market briefs: NZ and Australian milk production; USDA Semi-Annuals

• Engaging at the APEC meeting in Detroit

• USDEC urges support for increased FMC budget

Featured

Eucolait meeting culminates with new MOU

USDEC staff led by President and CEO Krysta Harden traveled to Warsaw, Poland, this week for the annual Eucolait General Assembly. The purpose of the trip was twofold: Harden spoke at a May 25 panel presentation, “Who will satisfy the growing global demand for dairy?” and USDEC signed a Memorandum of Understanding with the European dairy trade organization to strengthen innovation and trade, share information and bolster the image of dairy.

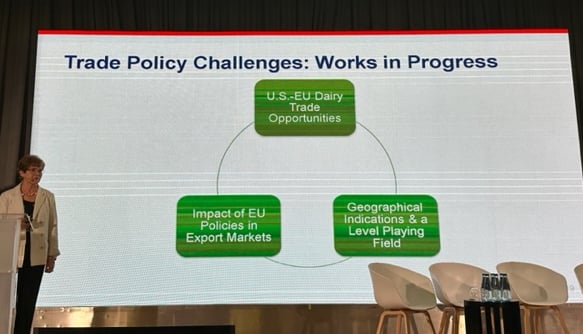

During her presentation, Harden highlighted the imbalance in the U.S.-EU dairy trade relationship and contentious issues like the EU’s misuse of geographical indications to limit competition in global markets. But she also highlighted areas where the U.S. and Eucolait could find common ground to address trade policy challenges.

- Both groups are interested in improving trade flows. (USDEC has worked with Eucolait as an ally on several occasions to address third-country trade barriers and resolve EU certificate disputes.)

- Both share a joint concern regarding policies driven by anti-dairy activists and through pressure from groups like the World Health Organization.

- Both support science-based regulatory decision-making.

- Both look to gain market access where neither country has an FTA while Oceania has lower tariffs.

- And both share concerns about how some of the EU “Farm to Fork” policies would impact dairy demand, impose new unwarranted burdens on dairy production in the EU, and result in new policies that would negatively impact trade flows in the EU and around the world.

USDEC President and CEO Krysta Harden outlines U.S.-EU trade policy challenges at this week’s Eucolait General Assembly in Warsaw.

USDEC President and CEO Krysta Harden and Eucolait President Frank van Stipdonk shake hands after signing the Memorandum of Understanding between the two dairy groups.

The MOU seeks to nurture that common ground and lays out seven objectives to do so. USDEC and Eucolait committed to:

- Facilitate the exchange of knowledge and collaboration on relevant issues of mutual interest between the parties, including trade and economics.

- Proactively promote alignment in support of common policy priorities in international forums like Codex and the UN Food and Agriculture Organization.

- Participate regularly in discussions and knowledge sharing on sustainability, sustainable food systems, and other environmental/production issues facing dairy producers and impacting dairy trade.

- Work collaboratively to facilitate global trade and remove barriers in third-party countries to dairy product exports from Europe and the United States.

- Reciprocally support effective and aligned participation of the parties within international organizations, including all those that establish policies that impact the agricultural sector.

- Promote the development of science-based international standards and guidelines that support the pre-competitive operation of world markets and the international trade of agricultural products based on standards.

- Promote the recognition and support of influential actors in relation to the fundamental role of livestock, animal protein and dairy products, specifically in advancing sustainable development and more sustainable food systems.

USDEC and Eucolait plan to meet at least once a year to review major topics of interest and collaboration. The MOU will run through the end of 2024 and may be renewed at the agreement of both organizations.

USDA AMS modifies dairy certificate fees

AMS Dairy Grading announced in the May 22 Federal Register a fee increase for the next fiscal year, which begins Oct. 1, 2023. The fee for a dairy certificate will increase from $95 to $104, certified copies will rise from $47.50 to $52, and an uncertified copy will increase from $8 to $12. USDEC has updated Volume 2 of the Export Guide to reflect these new fees.

Reminder on transition to new APHIS certificate template

The grace period to transition to the revised APHIS VS 16-4 template ends June 4. APHIS will require all exporters to use the JUL 2022 version of the APHIS Export Certificate VS 16-4 as of June 5. See the April 5 Member Alert for more information and Volume 2 of the USDEC Export Guide for a link to the new certificate template. Contact Sandra Benson at sbenson@usdec.org with questions.

USDEC’s latest Market Snapshot on Southeast Asia now available for download

USDEC’s Strategic Insights department published its newest members-only Market Snapshot covering Southeast Asia. The three-page mini-research report highlights the region’s potential for U.S. dairy export growth and what U.S. suppliers can do to maximize their business.

While emphasizing differences in product preference and income among countries in the region, the Market Snapshot also delves into overall trends, including a strong focus on health and wellness. U.S. dairy ingredient suppliers who target health and wellness trends, such as the “clean eating” movement and the “superfood” movement, should find interest among Southeast Asian food and beverage manufacturers.

In addition, the Southeast Asian foodservice sector is creating opportunities for U.S. dairy products like cheese. The region’s foodservice industry is one of the fastest growing in the world, and consumers visit restaurants, food courts and street food stalls with more frequency than the global average. Cheese is becoming popular in traditional Indonesian dishes, for example, while consumers are also adopting common Western foods like pizza and fusion options that merge traditional and Western tastes.

The release of the new research coincides with a June 1-9 USDEC farmer mission to Singapore. Watch Global Dairy eBrief in the coming weeks for more on that trip. Click here to download Market Snapshot: Southeast Asia.

Events

First Korean Whey Protein Forum of 2023 focuses on bakery applications

Fifteen health professionals and journalists attended this year’s first South Korean Whey Protein Forum on May 18 in Seoul. The Korea Food Forum (KOFRUM). working with USDEC, established the Whey Protein Forum in 2021 to communicate reliable, science-backed information about dairy protein’s health and nutritional benefits to Korean media and consumers. It has met three times annually for the past two years.

The May 18 event focused on opportunities to increase protein intake at breakfast and throughout the day with whey-protein-fortified bakery products. Speakers Jung-Ah Han, professor at Sangmyung University’s Department of Foodservice Management and Nutrition, and bakery specialist, Younggwan Lee highlighted whey-inclusive versions of common Korean bakery foods, breaking down perceptions that whey protein is only for sports nutrition products.

Brownies, bread, cookies and more

Professor Han discussed the physical and sensory characteristics of brownies made with whey, presenting sensory research she conducted showing that whey brownies scored high for taste, texture, flavor and overall consumer preference. In addition, products like whey brownies align with the nutritional preferences of Korea’s rapidly aging society, Han said, referencing a study she published in the Journal of the Korean Society of Food Science and Technology that showed Korea’s senior population wants to consume nutrients through 1) bread, 2) rice cakes and 3) beverages.

Lee discussed using whey protein to make protein-boosted, “better for you” versions of five common bakery applications in Korea: white pan bread for sandwiches, general bread (a Korean term for bread with eggs), custard cream buns, scones and cookies. Besides raising protein levels, WPC80 also increased the volume—another benefit that would appeal to the country’s bakers, Lee said.

“Participants sampled two of Lee’s prototypes and commended their taste and sales prospects,” said Kristi Saitama, vice president, Global Ingredients Marketing. “The nutrition key opinion leaders at the forum were generally receptive and enthusiastic about the concepts presented and the future market potential.”

The second 2023 Whey Protein Forum is slated for early August.

Brazilian workshop highlights U.S. dairy ingredient benefits in yogurt and cheese manufacturing

USDEC, in partnership with the Brazilian Institute of Food Technology (ITAL), held two U.S. dairy ingredient workshops in Campinas, Brazil, on U.S. dairy protein use in yogurt processing and cheesemaking, respectively. Representatives from Brazilian food and dairy processors and importers, including major names like Nestlé, Danone, Alibra and Frutap, participated in the training, which took place May 11 and 12.

The workshops combined classroom and pilot-plant instruction. Nineteen people attended May 11, which was devoted to high-protein drinkable yogurt. Fifteen people attended May 12, which focused on requeijão, a domestic Brazilian spreadable cheese. Twelve attended both days. Instructors led the classes through the manufacturing process for both products, demonstrating multiple formulations using U.S. MPC and WPC, including a “light” version of requeijão to address Brazilian front-of-pack labeling requirements.

Brazilian R&D professionals, analysts, coordinators and other food and dairy company representatives listen as an ITAL instructor explains U.S. dairy protein use in yogurt manufacturing.

A workshop participant samples one of multiple drinkable yogurt formulations made with U.S. dairy protein.

Making requeijão cheese at the pilot plant during the workshop.

In addition to the technical training led by ITAL’s Dr. Patricia Blumer, the workshops featured USDEC presentations highlighting U.S. dairy industry sustainability programs and U.S. dairy ingredient processing technology, quality, functionality and application benefits. Two USDEC members also attended the events to connect with end-users and gain additional knowledge on the featured applications.

Market Summary

Chinese dairy imports hold steady in April

Year-over-year Chinese dairy imports (major products, not including fluid) rose for the third straight month in April—but just barely. Volume gained 0.8%, and there is an air of demand recovery, albeit fragile and very uneven from product to product.

On the plus side, year-over-year SMP imports jumped 45% in April (+11,129 MT) and were up 20% year to date. Whey (0404.10) grew 5% in April (+2,555 MT) and was up 40% year to date. Cheese increased 19% (+2,055 MT), with year-to-date volume up 7%. And lactose soared 38% in April (+4,802 MT) and was up 28% year to date.

For all but lactose, those volumes lag China’s huge buying spree of 2021. But they are not far off that record pace and could challenge by year-end, depending on economic growth and assuming China’s ongoing pandemic conditions do not trigger a return to movement restrictions. (The country is riding another COVID wave that experts expect will crest at 65 million new cases per week in June.)

On the negative import side, a rebound in WMP and fluid milk imports is nowhere to be seen—COVID or no COVID. With China funneling much of its increasing domestic milk production into fluid and WMP processing, both categories continued their long-term import declines in April. Year-over-year WMP imports fell 31% (-19,321 MT); year to date they are down 58% (-243,456 MT). Fluid milk and cream dropped 13% (-9,466 MT) and were down 28% year to date (-106,117 MT).

China’s year-over-year WMP imports have declined in 13 of the past 14 months; its fluid milk and cream imports have dropped in 19 of the last 20 months.

Also lagging are WPC80+ volumes, which fell 30% (-1,100 MT) in April and were down 20% year to date. And while lower-protein whey imports (under HS 0404.10) continue to post gains, global whey suppliers will be facing some very strong comparable volumes in the second half of the year that will be challenging to match.

USDEC International Demand Analysis with March data ready for download

Year-over-year international dairy trade in milk solids equivalent (MSE) fell 0.8% in March, according to the latest USDEC International Demand Analysis. It was an improvement over February’s 3% decline but still marked the fifth year-over-year shortfall in the last six months.

Trade flow trends were similar to February, with strong buying in Latin America (Mexico +31%, South America +67%) countered by weakness in Southeast Asia (-20%) and essentially flat volume in China (-1%). One significant difference from February was the 5% gain in MSE volume to the Middle East/North Africa versus a 9% decline in February.

For more details on March global dairy trade, download the report here. This is the second month of the new and improved design for the International Demand Analysis, featuring fresh graphics, coverage of more countries, separation of UK from EU data and more. The report is packed with charts, graphs and commentary, providing members with a forward-looking glimpse at world markets from a U.S. exporter’s point of view. It analyzes demand in the key markets for cheese, NFDM/SMP, whey (HS Code 0404.10) and WPC80+, and also includes shorter summaries for lactose, butterfat and WMP. For questions and comments, please reach out to William Loux (wloux@usdec.org) or Stephen Cain (scain@nmpf.org).

Market briefs: NZ and Australia milk output; Dairy and Products Semi-Annual reports

Below is a quick roundup of other recent market news and developments:

- Spurred by good weather and excellent pasture conditions, New Zealand is finishing the 2022/23 season (June-May) on a strong note. Year-over-year milk production jumped nearly 7% in April, the fourth straight month of gains and the largest of the four. With one month remaining in the season, New Zealand output is only 0.8% behind the 2021/22 year. It will still finish the year in the red, but the January-April rebound has significantly narrowed the gap over the previous year (Kiwi milk production was off 2.6% through the first seven months of 2022/23).

- Australian milk production fell 1.7% in April. Year-over-year output has declined in each of the first 10 months of the July-June production year, but April’s -1.7% was the smallest of the streak. Season-to-date through April, Australian milk production was down 5.9%.

- USDA began releasing the 2023 Dairy and Products Semi-Annuals. The agency has released four so far. To download the reports, click on the respective country/region: Australia, China, the EU and Mexico.

Trade Policy

Morris meets with trade ministers at Detroit APEC meeting

USDEC Senior Vice President, Trade Policy Shawna Morris attended this week’s Asia Pacific Economic Cooperation (APEC) meeting in Detroit. APEC trade ministers, senior officials and working-level experts convened to discuss how to ensure that international cross-border trade flows smoothly and how trade can help address a variety of pressing challenges facing the world.

On the margins of those ministerial meetings, Morris met with the secretary of trade and industry from the Philippines, the minister of Trade and Export Growth from New Zealand, the minister of Foreign Trade and Tourism from Peru, the vice minister of trade from Chile and the associate secretary from Australia's Department of Foreign Affairs and Trade as part of a U.S. business sector delegation. She highlighted the importance of preserving smooth dairy trade flows with our FTA partners and of increasing trade relations further with the Philippines.

USDEC calls for increased funding for FMC

USDEC and NMPF coordinated an agricultural association letter to the leaders of the House and Senate Appropriations Committee, Subcommittees on Transportation, urging Congress to approve the President’s Fiscal Year 2024 budget request for the Federal Maritime Commission (FMC). President Biden called for a 14.25% increase in the FMC budget to $43.7 million to allow the agency to hire new staff to continue to effectively implement the Ocean Shipping Reform Act of 2022 (OSRA) and develop and issue the congressionally directed rulemakings.

While supply chain challenges and ocean shipping have improved with the easing of the pandemic, ripple effects continue to strain the U.S. supply chain network, the letter states. To address those challenges, prepare for potential upcoming supply chain crises and address the added responsibilities created by the OSRA, the FMC needs a budget commensurate with the task, the ag groups said.

Among the work that OSRA requires the commission to undertake are increasing oversight and enforcement activities that have been focused on addressing detention and demurrage fees, audits of ocean carriers, and other items of importance to American agriculture exporters and other shippers.

“We believe that the FMC’s significant new legislative mandates and the ongoing implementation of the regulations and additional institutional capacity necessitated by OSRA require further resources to ensure that the FMC continues to be an effective regulator for a critical segment of the supply chain,” the letter states.

In Case You Missed It...

U.S. Dairy Exporter Blog

Market analysis, research and news subscribe hereUSDEC Twitter feed

Follow us here.