HIGHLIGHTS: JUNE 16, 2023

• USDEC at CDIA

• West Coast labor talks deliver tentative contract

• Cooperation agreement with Japanese farmers

• More images from Singapore and South Korea farmer missions

• Indonesia approves more U.S. dairy plants to export

• Gruyere name challenge officially closed

• Mission looks to facilitate trade with the UK

• USDA trade mission to Japan

• Market Summary: EU milk deliveries slow

• Market briefs: NZ cheese capacity lagging; new GDT seller; Japanese SMP

• USDEC in global plastics dialogue

• Fonterra launches new nutrition business

• Company briefs: Synlait, Subway, Pizza Hut

Featured

USDEC emphasizes U.S. dairy ingredient possibilities, U.S. commitment to China at 2023 CDIA

More than 1.2 million people tuned in virtually to watch the opening ceremony of this year’s China Dairy Industry Association (CDIA) Annual Meeting, June 4-6, and another 800 or so saw it in-person at the conference center in Nanchang, Jiangxi Province, China.

In other words, the show attracts a massive audience of Chinese dairy and food industry professionals—an audience of potential U.S. dairy ingredient buyers that USDEC has increasingly deepened engagement with over the years.

USDEC has participated in the CDIA meeting in various capacities for more than a decade, showcasing the U.S. dairy industry’s desire to work with the Chinese dairy sector to grow Chinese consumption to the mutual benefit of both countries. Since 2018, that has included a speech at the high-profile opening ceremony and, for the past three shows, it has featured an in-depth USDEC-sponsored symposium: the China-U.S. Dairy Trade Development Forum.

This year, Annie Bienvenue, vice president, Global Ingredients Technical Marketing Services, delivered the main speech at the opening ceremony. Bienvenue (in a pre-recorded presentation) reminded the Chinese industry of USDEC’s investment in and partnership with China and the U.S. commitment to support mutually beneficial growth opportunities in food and beverage innovation using dairy ingredients.

Forum highlights cooperation, innovation

About 70 food and beverage company representatives attended the in-person U.S. Dairy Trade Development Forum after the opening ceremony. The symposium centered on innovation using U.S. dairy protein and permeate ingredients, with emphasis on how USDEC has worked closely with partners within China to develop products tailored specifically to local tastes.

Chang Su, USDEC China representative, outlined global trends in protein-containing products based on new product launch data from Innova Market Insights as well USDEC’s cooperation with Jiangnan University’s Dairy Innovation Center.

Bienvenue and speakers from the USDEC China office and USDEC partner Jiangnan University highlighted dairy protein and permeate nutritional and functional benefits and, in the case of permeate, cost-saving advantages.

In a prerecorded presentation, Annie Bienvenue, vice president, Global Ingredients Technical Marketing Services, highlighted local-friendly product prototypes made with U.S. dairy protein and permeate.

Professor Xiaoming Liu, Jiangnan University, reaffirmed the value of consuming dairy protein-fortified foods in the context of the Chinese diet and presented examples of foods “upgraded” by adding U.S. dairy protein ingredients. She highlighted a range of product prototypes developed by JU to fit the taste preferences of Chinese consumers, including high-protein potato chips, jelly, ice cream, bread and noodles. She also talked about the U.S. Dairy Student Innovation Competition created under the USDEC-JU partnership and the range of services offered by the JU Dairy Innovation Center.

Professor Xiaoming Liu, Jiangnan University (JU), highlights JU’s new product innovation work with U.S. dairy proteins.

Associate Professor Dr. Lina Zhang, Jiangnan University, highlights U.S. dairy permeate’s value in various food and beverage applications.

JU associate professor, Dr. Lina Zhang, reinforced permeate’s value to control costs and improve the nutrition of foods. Zhang showed JU-developed prototypes as well, including milk tea, ice cream, and a variety of reduced-sodium products: rice crackers, guoba (scorched rice), soup and a cooking sauce. She also showed how the dairy mineral in permeate can be used to make sports beverages and other “healthy” drinks like kombucha.

In addition, USDEC members presented at the symposium and at a tabletop exhibit during the event. In pre-recorded presentations, speakers from USDEC Arlington highlighted U.S. dairy’s world-leading sustainability programs, U.S. dairy supply reliability and the benefits of choosing the United States as the high-quality dairy ingredient supplier of choice.

CDIA Honorary Chairman Kungang Song (fourth from left), a revered authority in the Chinese dairy sector, introduced the symposium. He is joined here by USDEC China office representatives and USDEC members who participated in the symposium.

The symposium showcased product samples containing U.S. dairy proteins and dairy permeate, such as those above.

PMA, ILWU reach tentative agreement on new West Coast port labor contract

On Wednesday, after 13 months of negotiations, the International Longshore and Warehouse Workers Union (ILWU) and the Pacific Maritime Association (PMA) released a brief joint statement announcing a tentative agreement on a new six-year contract covering all 29 West Coast ports.

At press time, apart from the duration of the deal, the ILWU and PMA had not released details of the agreement. The tentative contract must now be ratified by the membership of the ILWU and the ocean carriers and terminal members of the PMA, a process which may take several months.

The PMA/ILWU statement acknowledges the assistance of Acting U.S. Labor Secretary Julie Su in reaching the deal, a point echoed by President Biden in a statement on the achievement. The president congratulated both parties, specifically calling out the port workers “who have served heroically through the pandemic and the countless challenges it brought, and will finally get the pay, benefits, and quality of life they deserve.”

USDEC and NMPF have been vocal and consistent with the Biden administration and Congress in expressing the need to settle the contract impasse. Earlier this spring, the two organizations joined more than 200 groups representing importers, exporters and others throughout the shipping supply chain in sending a letter urging the Biden administration to take a more active role in resolving the dispute so goods can continue to flow through the ports without disruptions.

Reaching this agreement all but assures no further work disruptions at West Coast ports, which had significantly upset cargo flows over the preceding 2 weeks, and intermittently over the past months. However, the contract discord is estimated to have resulted in up to a 15% shift in ocean carrier market share to ports on the East and Gulf Coasts. It is yet unclear if or when ocean carriers will restore those Pacific routes to the West Coast.

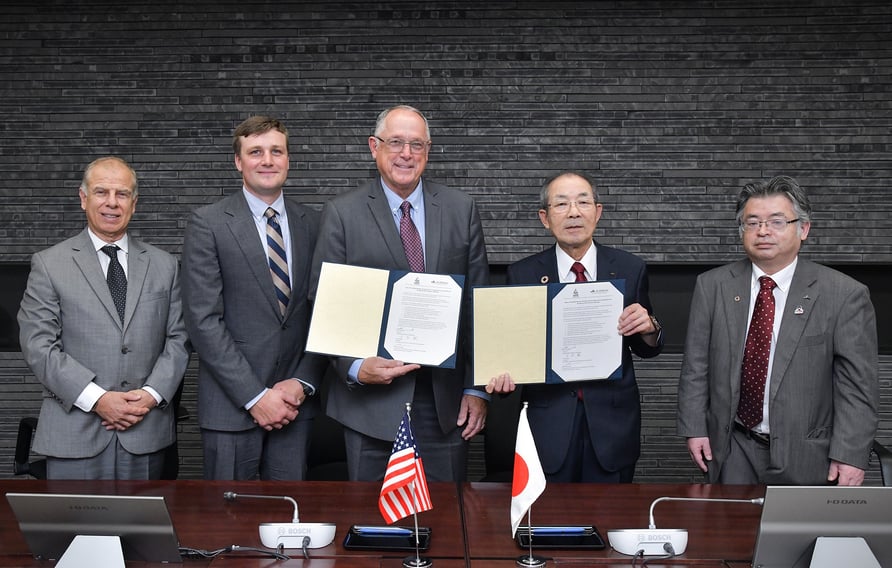

U.S. dairy farmers sign cooperation agreement with Japan

U.S. dairy farmers signed a “Letter of Friendship” with dairy farmers in Japan pledging to work together to address the difficulties milk producers are facing in both countries. In the agreement, officially between NMPF and Ja Zenchu (Japan’s Central Union of Agricultural Cooperatives), the U.S. and Japan promised to collaborate on “dairy-friendly policies at international forums, share information and knowledge on relevant issues and continue to strengthen ties between the two countries for the good of the dairy farmers we represent.”

The Letter of Friendship is similar to agreements signed with dairy farm groups in Latin America, recognizing issues where both parties can work together to facilitate mutual growth. That would include defending the image of dairy based on science, expanding dairy consumption, and cooperating on public policy on sustainability and animal welfare.

Jaime Castaneda signed the pact in his capacity as NMPF executive vice president for policy development and strategy. USDEC Chairman Larry Hancock, who was visiting Japan as part of USDEC’s broader mission to East Asia, also took the opportunity to sign the document as a U.S. dairy farmer.

U.S. and Japanese dairy farming representatives pose with the signed Letter of Friendship.

Japan U.S. dairy farmer mission

Hancock and Alex Peterson, USDEC vice chair, flew to Japan from last week’s farmer mission to Singapore. The Japan leg of the trip sought to strengthen the relationship between the U.S. and Japanese dairy communities, harnessing Hancock and Peterson’s special roles as emissaries for the U.S. dairy industry.

It also was a fact-finding mission for USDEC leadership to gain a better understanding of U.S. export growth potential in Japan and USDEC’s role in supporting the industry to realize that potential. The USDEC delegation met with farmers in a town hall in Hokkaido (the dairy heart of Japan) hosted by JA (Japan Agricultural Cooperative) and talked one-on-one during direct visits to two area farms.

By meeting with Japanese dairy farmers and agriculture leaders as well as a leading manufacturer (Megmilk Snow Brand), the USDEC delegation gained valuable insights into the Japanese dairy market and industry opportunities and challenges.

Larry Hancock and Alex Peterson visited two modern, multigenerational dairy farms on Hokkaido, where they toured the operations and discussed challenges facing milk producers in both countries. Here, Hancock (left) and Peterson (right) stand with farmer Yusuke Handa who milks 80 head and supplies Megmilk Snow Brand’s Taiki manufacturing plant. The Handa farm also makes and sells soft-serve ice cream and cheese on site.

The USDEC Japan delegation toured Megmilk Snow Brand's Taiki, Hokkaido, plant, which primarily makes cheese (camembert, gouda, string cheese, cottage cheese, mascarpone and cream cheese) for consumer retail, food service and industrial uses. The Taiki plant also dries some food-grade whey powder.

“Through open and honest dialogue, the Hokkaido activities helped us make strides to strengthen U.S.-Japan dairy community friendship, reinforcing areas of similarities and mutually beneficial opportunities,” said Castaneda. “For example, we can mutually support growing demand and consumption of dairy in Japan as well as in other Asian markets too, essentially growing the pie in a way that benefits both U.S. and Japanese dairy farmers and manufacturers.”

“U.S. and Japanese dairy farmers share a commitment to quality and sustainability, as well as facing common obstacles in their daily farm operations,” said Hancock. “For example, we both experienced unprecedented demand/supply disruptions during the pandemic which Japan is still recovering from, and we are both dealing with high input costs.”

Additional Images from U.S. dairy farmer mission to Singapore, South Korea

While some of the farmers who accompanied the mission to Southeast Asia last week returned home, other attendees splintered off for visits to Japan and South Korea.

What follows are additional images from the Singapore and Korea legs of the mission. For additional images and social media posts from the first week of the trip to Singapore, read the “Travelogue” on the mission posted on the U.S. Dairy Exporter Blog. In addition, we are continually updating the USDEC Twitter page with the latest developments from the trip, including this montage video “Seven dairy farmers share their impressions of the U.S. Center for Dairy Excellence.” Also, watch for next week’s Global Dairy eBrief a final wrap-up of the trip.

USDEC President and CEO Krysta Harden (far right) and the U.S. farmer delegation attended a reception with U.S. Ambassador to Singapore Jonathan Kaplan (fourth from right). Kaplan congratulated USDEC for making a “smart choice” in selecting Singapore/Southeast Asia as the location and food innovation as the focus of the U.S. Center for Dairy Excellence, which he called “one of a kind.”

The USDEC delegation met with major Singaporean cheese importer GTK Foods to hear about Southeast Asian cheese trends and answer questions about U.S. dairy farming and the U.S. cheese portfolio.

The farmer delegation and USDEC staff visited three USDEC member facilities during the Singapore visit. The previous three photos from the top show the group 1) At Dairy Farmers of America’s Southeast Asia office, 2) at Glanbia Nutritionals’ Singapore Innovation Centre and pilot plant, and 3) at Leprino Foods’ Singapore Innovation Studio.

Dairy farmer Marilyn Hershey, USDEC President and CEO Krysta Harden and USDEC Korea representative Shin Chung sample cheese at a wine-and-cheese promo at a South Korean Enoteca wine store.

Harden shows off some U.S.-made Kirkland brand cheese at a Seoul Costco store.

Indonesia lists additional plants for export

As a result of ongoing USDEC engagement efforts, most recently a meeting last week between USDEC Senior Vice President, Trade Policy Shawna Morris and Indonesian embassy agriculture and trade staff, Indonesia completed the approval process for five new U.S. dairy plants for export. The Market Access and Regulatory Affairs and Trade Policy teams continue to work with the U.S. government on current applicants and persuading Indonesia to streamline its excessively lengthy plant approval process. (Also see Global Dairy eBrief 3/3/23.)

U.S. legal battle over gruyere officially closed

The legal battle in the United States over the generic nature of “gruyere” is officially over. The European consortiums seeking to monopolize the use of “gruyere” in the U.S. chose not to appeal a U.S. Circuit Court of Appeals decision earlier this year that preserved common use of “gruyere” (see Global Dairy eBrief, 3/3/23). An appeal to the U.S. Supreme Court was their last recourse to challenge previous rulings from two lower courts and the U.S. Patent and Trademark Trial and Appeal Board.

The series of decisions and the failure of the consortiums to appeal to the Supreme Court by the filing deadline add up to a landmark victory for U.S. dairy and the Consortium for Common Food Names (CCFN). CCFN, backed by its member companies, USDEC and NMPF, committed significant resources to build the case for gruyere as a generic term and crafting a successful argument that non-European companies should retain their rights to make and sell the cheese in the U.S. (CCFN was founded by USDEC.)

While CCFN and USDEC celebrate this victory as a major precedent for common food and beverage terms in the United States, challenges in export markets persist due to a lack of sufficiently strong efforts by U.S. administrations over the past several years. A continued partnership among U.S. food and beverage manufacturers, including U.S. cheesemakers, is invaluable as CCFN works to oppose bad-faith trademark applications worldwide and to establish protections from restrictions in the future.

UK trip seeks to facilitate U.S.-UK dairy trade

Tony Rice, USDEC manager, Trade Policy, was in the UK this week as part of a Wisconsin Department of Agriculture, Trade and Consumer Protection (DATCP) mission to explore opportunities for expanded agricultural trade. Rice met with U.S. and UK government officials (including Kathy Yao, agricultural attaché for the U.S. Embassy in London) to discuss USDEC’s most favored nation (MFN) tariff project and the UK’s proposed new dairy health certificate.

As in key U.S. markets in Asia (see Global Dairy eBrief, 3/24/23), USDEC is working to make the case for the UK government to unilaterally reduce MFN tariff rates for a range of dairy imports, including cheese. In a separate meeting with officials from Britain’s Department for Environment, Food and Rural Affairs (DEFRA), Rice discussed the agency’s proposed new approach to health certificates under the Border Target Operating Model. USDEC is asking for most U.S. dairy products to be categorized as “low risk,” which would eliminate the need for redundant certificate processes and align documentation requirements for U.S. dairy exports with those mandated for EU exports to the UK.

USDEC members also took part in the DATCP-organized trip, whose broader purpose was to explore opportunities to increase trade in food, forestry and ag products with the UK. Wisconsin’s Secretary of Agriculture, Randy Romanski, led the mission, which included buyer meetings, store visits, market briefings and meetings with regulatory entities.

Left to right: Jennifer Lu, DATCP; Colleen Francis, Masters Gallery; Tony Rice, USDEC; Shirley Acedo, DATCP; Sam Allison, Sartori; Mark Rhoda-Reis, DATCP; Randy Romanski, Wisconsin Secretary of Agriculture, Trade and Consumer Protection; and Georgia Marshall, Red Communications. The group, a subset of those that participated in the trade mission, is standing in front of Paxton & Whitfield, one of the oldest cheese shops in London and a supplier of cheese to the royal family.

Events

USDA leads ag trade mission to Japan

On June 5-8, the week before USDEC’s farmer visit to Japan, USDA held its own mission to the country. Under Secretary for Trade and Foreign Agricultural Affairs Alexis Taylor led representatives from more than 40 U.S. food and beverage producers, agricultural associations, and state ag department officials on a four-day visit to facilitate U.S. exports to Japan. The itinerary included face-to-face meetings between the U.S. participants and Japanese buyers, meetings with Japanese government officials and industry groups to discuss trade issues and opportunities, and visits to Japanese farms and packaging facilities.

USDEC’s Japan office was engaged in many aspects of program and sat down with Under Secretary Taylor to outline the current impact and ongoing threat of the EU’s geographical indications overreach on U.S. cheese sales in the No. 3 U.S. cheese export market. USDEC member MCT Dairies also participated in the mission.

Market Summary

EU27+UK milk deliveries slow in April

With 22 of 28 countries reporting April numbers, EU27+UK milk production growth appears to have cooled significantly. Year-over-year deliveries were flat after seven straight months of gains ranging from +0.8 to +2.1%.

Significant declines in Italy (-7.4%), Ireland (-2.9%) and France (-2.0%) negated strong gains in Germany (+3.3%) and Poland (+2.2%) in April. The Netherlands is yet to report and remains on a steady growth streak, so the final April estimate could get a positive boost when all numbers are in. Still, April’s results, coming one month before the EU peak and with farmgate milk prices continuing to erode, is an early signal of an expected second-half slowdown in EU27+UK production.

Market roundup: NZ needs cheese capacity; new GDT player

Below is a quick recap of recent market news and developments:

- Westpac dairy analyst Nathan Penny criticized New Zealand’s preparedness to take advantage of strong growth in global cheese markets. Ideally, the country would be channeling more milk away from WMP and into cheese, but “at least in the short term, New Zealand dairy companies have limited factory capacity to produce more cheese,” he said. Penny expects cheese price strength and relative WMP weakness will continue through the end of the year.

- Belgian dairy processor Solarec is joining Global Dairy Trade, although neither GDT nor the company reported the date it would be doing so. Solarec is majority owned by Belgian dairy co-op Laiterie des Ardennes, but four other co-ops—Germany’s Hochwald, Luxembourg’s Luxlait and France’s Laitnaa and Avesnois-Lait—each have a small stake in the company. Solarec manufactures mainly milk powder (110,000 MT/year) and butter (50,000 MT/year), although it recently added mozzarella capacity (32,000 MT/year).

- Japanese SMP inventories rose slightly (+2%) in April but remained below 70,000 MT and were still a far cry from last year’s run-up to record highs of over 100,000 MT. March was the first time in three years that they were below 70,000 MT. Government programs to incentivize use have helped to lower stockpiles, but their impact appears to have slowed in April. The Ministry of Agriculture, Forestry and Fisheries says it will continue efforts to curb production and reduce inventories. Year-over-year Japanese milk production declined for the ninth consecutive month in April, falling 4.4% versus the April 2022. Higher retail milk prices have been eroding demand since November, and another price hike for beverage milk is expected in August. (USDEC Japan office; Company report; Global Dairy Trade)

Sustainability and Multilateral Affairs

SAMA represents U.S. dairy in global plastics policy dialogues

Kelly Sheridan, USDEC’s vice president, Environmental Affairs, was on the ground to represent U.S. dairy during a recent negotiation to establish an international treaty on plastics waste that could have significant impact on policy in many key U.S. dairy export markets.

The second session of the Intergovernmental Negotiating Committee to Develop an International Legally Binding Instrument on Plastic Pollution, including in the Marine Environment (INC-2), kicked off on May 29. Sheridan has been participating in these negotiations, which flow out of decisions taken by the UN Environment Program, since the beginning to manage risk to U.S. dairy production and exports that come from emotionally charged, top-down approaches to complex global problems like marine litter.

From the beginning, the negotiations were plagued by procedural issues, but the outcomes ended up mostly favorable. In particular, the group moved away from earlier European advocated approaches to ban certain plastic resins or prohibit the development of new resins, which could have been very disruptive throughout the innovative dairy value chain. While the next step is to develop the actual text of the agreement, this round set an important floor that largely rules out many of the worst-case scenarios for U.S. dairy exports.

USDEC worked diligently ahead of and during the meeting with allied organizations, the U.S. government and other stakeholders to share the positive efforts the U.S. dairy industry has taken to manage plastics waste and to share potential negative consequences for U.S. dairy’s own sustainability efforts with heavy-handed plastic-ban approaches. These negotiations will recommence for a third round in November 2023.

Concurrent code of conduct work

At the same time, USDEC is also engaging in the development of a Voluntary Code of Conduct on the sustainable use of plastics in agriculture being led by the UN Food and Agriculture Organization (FAO). Although voluntary, FAO’s code will establish an important global standard on plastic use on farms and is likely to shape regulations around the world. Allowing the code to be dominated by unrealistic aspirations or non-scientific ideology has the potential to create trade barriers for U.S. dairy products and endanger U.S. dairy’s social license to operate.

The good news is U.S. dairy will have a seat at the table to manage these potential risks and share the proactive efforts U.S. stakeholders have already undertaken to reduce plastic use and increase collection efforts on dairy farms. Nick Gardner, USDEC’s Senior Vice President, Sustainability and Multilateral Affairs (SAMA), was selected to participate in an FAO convened global expert group. The global expert group, which will meet later this month, will provide FAO with a realistic assessment of how, where and why plastics are used in agriculture, share examples of good practices related to the sustainable use of plastics, and identify possible solutions for improvement.

If you would like to learn more about these global plastics issues or have examples of good practices or plastic initiatives your organization has developed, please contact Kelly Sheridan at ksheridan@usdec.org.

Company News

Fonterra launches new nutrition science investment business

New Zealand’s Fonterra Co-operative Group formed a new, stand-alone corporate investment arm to incubate, scale and invest in new, innovative nutrition science businesses. Provisionally named Nutrition Science Solutions (NSS), the business will “incubate and scale a portfolio of disruptive ventures by developing solutions that combine science, nutrition and technology to make a real impact on human health,” Fonterra CEO Miles Hurrell said.

NSS will seek out, partner and invest in global start-ups with emerging technologies and in novel market channels. Its first investment is a US$10 million minority share in California-based Pendulum, a biotech company focused on developing microbiome-targeted products that advance metabolic health. Together, Fonterra and Pendulum say they will seek to establish a presence in global markets by co-developing and commercializing next-generation microbiome products that are scientifically formulated to make measurable improvements in people’s health.

Functional product expansion

Weeks prior to the NSS announcement, Fonterra also rolled out a new effervescent powdered probiotic drink in Singapore under its Nurture Digestion+Immunity label. The company based the product on consumer research that indicated interest in probiotic drinks (Southeast Asian consumers believe “that true wellness is impossible without a healthy gut,” Fonterra said) but with lower sugar content and a preference for effervescent beverages.

The company is already looking to expand distribution to Indonesia, Malaysia and Thailand.

Fonterra has been increasingly active in functional products over the past year—with varying degrees of success. A positive reception to ready-to-drink Nurture Digestion+Immunity beverages in Singapore in 2022 spawned the new powdered, effervescent product. Earlier this year, it also rolled out a line of Anchor Actif-branded products in Thailand (see Global Dairy eBrief, 2/17/23). However, Fonterra’s BioKodeLab supplement line launched last October has already been “put on hold.” (USDEC Southeast Asia office; Company reports; DairyReporter.com, 5/23/23)

Synlait to sell two businesses

New Zealand dairy processor Synlait plans to sell Dairyworks (its cheese products division) and Talbot Forest Cheese (a related consumer business unit). Synlait acquired both New Zealand businesses in 2019 in transactions valued collectively at about NZ$150 million (about US$92 million today). Synlait said it is narrowing its businesses to focus on its highest margin segments: B2B advanced nutrition and foodservice. (Radio New Zealand, 6/6/23)

Company news briefs

Subway reached an agreement with Chinese master franchisee Shanghai Fu-Rui-Shi Corporate Development to open 4,000 new sandwich shops across China over the next two decades. It is the largest franchise agreement in Subway’s history. There currently are around 500 Subway stores in China. … California-based Flynn Restaurant Group plans to buy Pizza Hut Australia, including the franchise license for the entire country. Australia-based investment firm Allegro Funds currently owns Pizza Hut Australia. Flynn operates about 950 Pizza Huts in the U.S.; the deal—its first outside the United States—will give it another 260. … Mars Inc. is aiming to grow its global ice cream business from $400 million in sales to $1 billion by 2030. Mars said it is eyeing growth in places where it already has ice cream factories, as well as in emerging markets. “Ice cream is about a $80 billion category around the globe, and it’s going to be about $100 billion by 2030,” said Anton Vincent, president of Mars Wrigley in North America and who recently took over global ice cream responsibilities. (Nation’s Restaurant News, 6/7/23; Reuters, 6/6/23; Bloomberg, 5/24/23)

In Case You Missed It...

U.S. Dairy Exporter Blog

Market analysis, research and news subscribe hereUSDEC Twitter feed

Follow us here.