HIGHLIGHTS: February 17, 2023

• USDEC to assist with entries to International Cheese and Dairy Awards

• Korea to implement new veterinary drug rules

• USDEC meets with Alexis Taylor

• Membership renewal reminder

• USDA ag mission to Japan

• China roundtable slated for Spring Membership Meeting

• Still time to register for TPM23

• Tony Rice talks exports with Pennsylvania farmers

• Market Summary: EU27+UK milk production flat in 2022

• Storms continue to hammer New Zealand

• Company news: Fonterra, FrieslandCampina, Namyang, Subway

Featured

Enter Now! USDEC assisting with entries to International Cheese and Dairy Awards

The International Cheese and Dairy Awards are a world-renowned dairy competition that takes place each year in the UK. As we have done in the past with other international cheese competitions, USDEC is supporting U.S. cheesemaker participation in the awards by covering the entry costs for U.S. cow’s milk (including mixed milk) cheeses.

Participation in global cheese competitions helps raise the profile of the United States as a world-class cheese supplier. U.S. success in previous contests has enhanced the reputation not only of the winning U.S. cheesemakers but the entire U.S. cheese and dairy industry.

“We hope to have a large contingent of U.S. cheeses at the show to amplify the broad portfolio of U.S. cheese, the quality of our products, and the skill and knowledge of our cheesemakers,” says Ryan Hopkin, USDEC manager, cheese marketing communications. “We supported 95 entries at last year’s ICDA, and the U.S. won 70 medals.”

This year’s ICDA takes place June 29-July 1, 2023, in Stafford, England.

How to participate

Members interested in participating can begin the entry process by clicking on this link. If you’ve participated in the ICDA before, you can log in to your account and begin registering cheeses, but if you haven’t participated before, you will need to register for a new account. No export capabilities are necessary to participate. Registration closes May 15, 2023, but we encourage you to act quickly since the number of cheeses USDEC is covering may be limited, depending on overall interest.

Once you pay for the entries, please send the following information to Alex Parker (aparker@usdec.org) and Nuhami Alemu (nalemu@usdec.org):

- A receipt of the registration fee detailing the entered cheeses.

- A copy of your credit card statement detailing the amount paid in U.S. dollars.

- A copy of your company’s W9.

Once USDEC has received the information and confirmed that the entered cheeses are eligible for reimbursement, we will ask you to issue an invoice to repay the cost of entry. For more details about U.S. entries, click here. Please contact Alex Parker (aparker@usdec.org) with any questions.

Korea to implement new veterinary drug rules; members encouraged to verify if Import Tolerances needed

South Korea's Ministry of Food and Drug Safety (MFDS) will implement a Positive List System for veterinary drugs (including Maximum Residue Limits) starting Jan. 1, 2024.

The veterinary drug Maximum Residue Limits (MRLs) list and the list of substances that shall not be detected in foods are stated in Volume 3 of the USDEC Export Guide. We encourage you to see if any veterinary drugs are missing from the list to determine whether you should obtain an Import Tolerance (IT).

An IT is an MRL for a substance for which there is no set MRL in Korea but which is legally allowed to be used in or on food in exporting countries. An IT is set when results of safety assessments on the food for which the substance was used to indicate that there is no concern for risk to human health.

Please note the following relating to the Positive List and MRLs:

- In the absence of Korean MRLs or ITs, the default limit of 0.01mg/kg shall be applied to milk.

- For growth promoters (ingredients used for accelerating growth, increasing weight, etc.) and steroid-type anti-inflammatory drugs, a “non-detection” limit shall be applied if there is no established MRL or an IT.

MFDS says entities can apply for ITs at any time. Details can be found in the “Manual on Import Tolerances Application” that is linked on the USDEC Export Guide Country Dashboard for Korea. If you have any questions, please contact Eddy Fetzer at efetzer@usdec.org.

USDEC highlights dairy trade priorities in two meetings with Alexis Taylor

USDEC President and CEO Krysta Harden, Executive Vice President, Policy Development Jaime Castaneda, and Senior Vice President, Trade Policy Shawna Morris are meeting today with new USDA Under Secretary for Trade and Foreign Agricultural Affairs Alexis Taylor. Castaneda and Morris are convening with Taylor this morning to review U.S. dairy trade priorities and areas of concern. The meeting aims to reinforce U.S. dairy priorities USDEC communicated in a January letter to Taylor and Doug McKalip, the new Chief Agricultural Negotiator at the USTR.

Those issues include expanding markets through the negotiation of new free trade agreements (prioritizing major dairy-importing countries), establishing explicit protections for common food names to combat the misuse of geographical indications, advocating for science-based standards and trade rules in multilateral organizations and more (see the January letter or Global Dairy eBrief, 1/27/23 for the complete list).

Harden and Morris will then meet with Taylor in the afternoon with other ag CEOs to outline areas of common interest, such as improved market access. The meeting aims to provide the new Under Secretary with a strong grounding on cross-agricultural priorities.

Membership renewal due March 15

All USDEC members should have received membership renewal notices in January. If you have not received the invoice or if you have any questions, please contact Weston Abels at wabels@usdec.org. Membership renewal fees are due by March 15. Thank you, and we appreciate your support!

Events

Applications due Feb. 27 for FAS Japan trade mission

USDA’s Foreign Agricultural Service (FAS) is inviting U.S. ag exporters to participate in a trade mission to Tokyo and Osaka, Japan. The trip takes place June 5-9, but the application deadline is Monday, Feb. 27.

“This trade mission will help many U.S. agribusinesses establish new business connections with their Japanese counterparts and further expand U.S. agricultural exports to this key Asian market,” said FAS Administrator Daniel B. Whitley.

The mission will include presentations from government and industry leaders on local market conditions and visits to local retail stores and food manufacturers. FAS staff in Japan will arrange meetings between participants and potential buyers. For more information on the Japan trip, including an online application form, click here.

Membership Meeting: Roundtable to explore China

After a banner 2021, the world’s largest dairy importer, China, decreased imports by nearly 370,000 MT in 2022. What can we expect this year and what opportunities and challenges will China present U.S. dairy suppliers in the months ahead?

Come to the USDEC spring Membership Meeting to hear an expert panel explore those questions and more in the session, “Hurdles and Opportunities for U.S. Dairy in China.” Daniel Chan, president, USDEC China; Virginia Chan, executive director, USDEC China; Eddy Fetzer, USDEC senior director of Market Access and Regulatory Affairs; Tony Rice, manager, Trade Policy; and Annie Bienvenue, USDEC vice president, global ingredients, Technical Marketing Services, will touch on everything from Chinese economic growth to regulatory challenges to USDEC ingredient marketing activities.

The meeting runs March 27-29 at the Willard Intercontinental Hotel in Washington, D.C. Download the preliminary agenda to see the full slate of invited and confirmed speakers. Register for the meeting by clicking here.

This will be the only USDEC Membership Meeting this year, and there will be no virtual attendance option (although most sessions will be recorded and made available online sometime after the event).

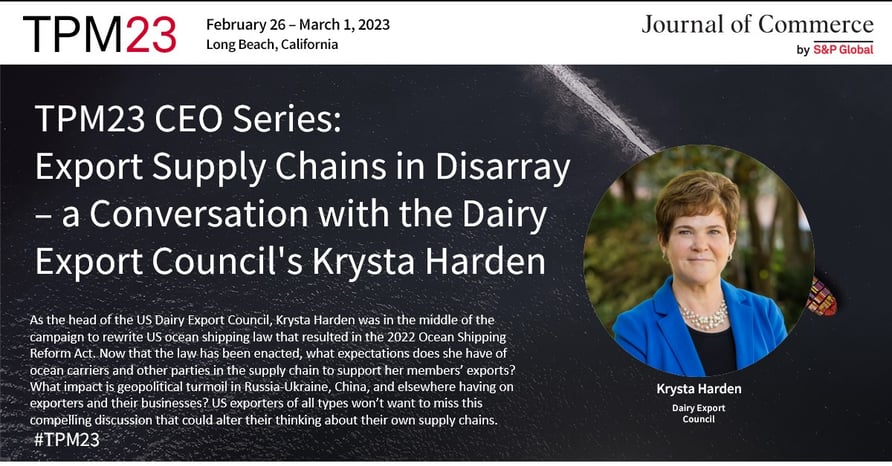

Still time to register for TPM23

More than 50 trade experts from across the import and export industries, including USDEC President and CEO Krysta Harden, will explore the state of shipping at this year’s TPM23 conference on Feb. 26-March 1 in Long Beach, California.

Organized by the Journal of Commerce within S&P Global Market Intelligence, TPM is the premier conference for the trans-Pacific and global container shipping and logistics community.

The organizers are offering USDEC members a special 25%-off rate to attend this year’s conference. For more information, visit the TPM23 website. To register, click here and use the special discount code USDEC23.

Educating the U.S. industry on dairy exports

Keeping U.S. dairy farmers informed and maintaining their support for exports is an ongoing USDEC mission. At last week’s Pennsylvania Dairy Innovation Forum, USDEC Manager, Trade Policy, Tony Rice spoke to a group of dairy producers from throughout the region on the meeting’s theme: export opportunities. Rice outlined long-term U.S. dairy export growth—capped off by this year’s record volume and value numbers—and opportunities for further expansion as global demand continues to increase. Despite challenges facing U.S. dairy suppliers, he said, USDEC believes the United States will be able to take advantage of existing and new opportunities and continue to thrive.

Market Summary

EU27+UK milk production finishes the year flat

Steady gains in the last four months of the year brought EU27+UK milk production back to even in 2022. With only a couple of countries yet to report December data, EU milk deliveries for the calendar year were up 0.1%.

December deliveries rose 1% over the previous year, led by gains from Ireland (+7.45), the Netherlands (+4.1%), Germany (+3.1%), Poland (+1.7% and the UK (+1.5%). The December increase would have been even higher had Italy (-3.6%) and France (-1.3%) not faltered.

France, the region’s No. 2 milk producer, finished the year down 0.9%. The bloc’s top milk producer, Germany, finished the year flat. In terms of pure tonnage, Poland and the Netherlands increased output more than any other state.

Despite declining farmgate prices and lagging growth in some key countries, the EU remains in an improved supply position at the start of the year compared to 2022.

Storms continue to pummel New Zealand

Extreme wet weather continues to plague New Zealand’s North Island and some major milk production regions. Just weeks after record rainfall drenched pastures, Cyclone Gabrielle struck the same region exacerbating the damage. Northland and Auckland were hardest hit, but the storms extended into parts of Waikato and down to Hawke’s Bay.

Power outages, flooding and road damage have hindered milking and milk pick-up, and some farmers are said to be considering drying off cows early. But the larger issue may be the impact on feed stocks. Farmers report sufficient feed to meet immediate needs, but the wet weather may challenge their ability to bank supplies for the winter.

Cyclone Gabrielle (coming on top of the earlier extreme weather) caused the government to declare a national state of emergency for only the third time in New Zealand’s history. Agriculture Minister Damien O’Connor also announced an NZ$4-million support package (about US$2.5 million) for farmers and rural communities struck by Gabrielle. O’Connor said the package could be expanded once authorities are able to conduct a full and thorough assessment of the damage. (OneNews, 214/23; Radio New Zealand, 113/23)

Company News

Fonterra launches functional dairy products in Thailand

Fonterra Co-operative Group rolled out two new functional dairy products in Thailand through an exclusive partnership with 7-Eleven. Anchor Actif-Fiber and Anchor Beaute are being sold at more than 14,000 7-Eleven stores across the country. Actif-Fiber is fortified with fiber to aid digestion. Beaute contains zinc and collagen and is being marketed as an “ingestible beauty” product that Fonterra says provides “an inside-out kind of glow.” (USDEC Southeast Asia office; Company reports)

Mergers, acquisitions and joint ventures

Subway confirmed that it is exploring selling their business and hired JPMorgan Chase to advise as it looks for potential buyers. Subway has 37,000 stores worldwide. Wall Street Journal estimates a sale price of about $10 billion. … The Seoul High Court upheld a lower court’s ruling and ordered Korean dairy processor Namyang Dairy to abide by a 2021 deal to sell a majority stake (53%) in the business to private equity firm Hahn & Co. Namyang’s owners claimed the deal was invalid just months after they made it, prompting Hahn to file the lawsuit. (Wall Street Journal, 2/14/23; Korea Herald, 2/9/23)

Company news briefs

FrieslandCampina is consolidating its butter production in the Netherlands. The company said that increased cream demand from the foodservice channel created a structural overcapacity in butter. FrieslandCampina plans to expand its Lochem plant and merge all butter production to that location, closing its 's-Hertogenbosch facility in mid-2025. … China’s Terun Dairy is raising funds to build a $145-million dairy processing plant in the Xinjiang Autonomous Region in northeast China. The facility will focus on shelf-stable dairy products. (USDEC China office; Company reports)

In Case You Missed It...

U.S. Dairy Exporter Blog

Market analysis, research and news subscribe hereUSDEC Twitter feed

Follow us here.